Finding Payday Loan Providers in Your Town

Finding Payday Loan Providers in Your Town

Blog Article

Optimize Your Financial Opportunities: The Advantages of Picking an Online Payday Advance Loan

On the internet cash advance financings have come to be a popular selection for individuals seeking instant monetary help. By thinking about the advantages of on-line payday financings, individuals can obtain understanding right into exactly how this alternative can properly address their temporary economic needs.

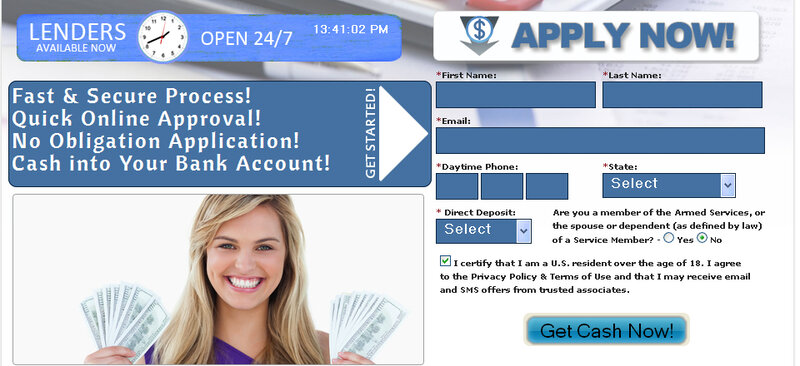

Fast Application Process

The speed of the application process is a substantial advantage of online payday advance loan. With simply a couple of basic actions, consumers can submit their application digitally and receive a choice in an issue of minutes. This fast turnaround time is particularly advantageous for people facing immediate unexpected costs or monetary demands.

Furthermore, the on the internet application process for cash advance car loans is developed to be uncomplicated and available to a variety of debtors. Fundamental individual and monetary info is commonly required, and applicants can easily upload any type of needed records directly to the internet site.

Convenient Online Accessibility

The seamless and reliable application procedure for on the internet payday advance loan not just guarantees quick access to economic aid yet likewise offers borrowers with practical on the internet accessibility to manage their finance deals easily. With protected mobile applications or on the internet portals, consumers can quickly examine their financing standing, evaluation payment timetables, and pay from the convenience of their very own homes or on the go. This practical access removes the demand for in-person sees to brick-and-mortar locations or extensive call to client service, saving consumers useful effort and time.

Moreover, on-line payday lending platforms frequently offer 24/7 gain access to, permitting borrowers to handle their economic needs whenever it is most practical for them. This flexibility is specifically advantageous for people with active schedules or those that might need to deal with immediate economic issues outside of traditional company hours. By giving an easy to use user interface and instant access to financing info, on-line payday finances empower consumers to remain informed and in control of their economic obligations with simplicity.

Flexible Settlement Options

A vital benefit of on-line payday advance loan is the schedule of versatile payment options tailored to meet customers' individual financial circumstances and preferences. Unlike conventional financings that typically have inflexible payment routines, on-line cash advance provide borrowers the adaptability to pick payment terms that best suit their demands. Debtors can usually select the financing amount and repayment duration that align with their spending plan and monetary objectives.

Online payday loan providers understand that unexpected expenditures or variations in income can make it testing for borrowers to stick to a stringent payment schedule. To address this, they supply various repayment options, such as time payment plan or the capacity to expand the finance term. This versatility allows debtors to handle their financial debt better and stay clear of coming under a cycle of financial debt.

Furthermore, on the internet payday advance usually give consumers with the benefit of setting up automatic payments or making manual payments online, making it much easier to stay on track with payments. By using adaptable payment choices, online payday lendings equip borrowers to take control of their finances and make borrowing a more clear and workable procedure.

Quick Authorization and Dispensation

Provided the comfort of establishing up automatic payments or selecting versatile settlement choices, on-line payday advance loan likewise succeed in giving rapid authorization and disbursement of funds. Among the key advantages of on-line cash advance loans is the speed at which customers can obtain the cash they need. Traditional bank car loans commonly involve lengthy authorization procedures, calling for comprehensive paperwork and credit rating checks that can take days or even weeks to complete. On the other hand, on-line payday advance loan applications can be finished in an issue of mins, with approval choices usually made within hours (Payday Direct Loans Online). As soon as accepted, funds are normally disbursed promptly, typically on the same day or the following company day.

This fast approval and dispensation process is particularly advantageous in emergency scenarios where instant access to funds is critical. Whether encountering unexpected medical expenditures, car repair services, or other urgent financial requirements, on-line payday advance loan give a fast and convenient option. By streamlining the application and approval process, online cash advance offer borrowers an easy means to safeguard the funds they call for quickly.

Accessibility for All Credit Score Kind

With on the internet payday advance loan, individuals of differing credit score histories can access economic aid quickly and easily. Unlike typical loan provider that usually need near-perfect credit history for authorization, on-line cash advance financing providers take into consideration a more comprehensive range of debt types. This inclusivity makes online cash advance an attractive choice for people that might have faced difficulties protecting funds with various other methods because of previous financial obstacles.

For those with inadequate credit rating, on-line cash advance offer a lifeline in times of immediate financial need. By focusing a lot more on current revenue and employment condition instead of solely on credit rating, these finances provide a viable solution for people that might have restricted straight from the source alternatives for obtaining cash promptly. Furthermore, also people with excellent credit history can profit from the access of on the internet payday advance loan, as they supply a effective and practical means to get temporary funds without the extensive paperwork and long term approval procedures regular of conventional financial institutions.

Final Thought

In final thought, choosing an online payday advance offers a hassle-free and fast way to access funds, with versatile settlement alternatives and quick authorization processes. No matter of credit score type, individuals can take advantage of the availability and ease of obtaining economic help through on-line cash advance. By making best use of these possibilities, individuals can successfully handle their financial demands and get over temporary cash money circulation obstacles.

The seamless and reliable application process for on the internet cash advance financings not just makes sure quick access to financial help however likewise offers borrowers with practical on the internet access to handle their lending transactions easily.Additionally, on-line cash advance funding platforms commonly use 24/7 gain access to, permitting borrowers to manage their monetary needs whenever it is most practical for them. By giving an user-friendly interface and instant access to funding information, online payday finances equip borrowers to stay enlightened and in control of their monetary obligations with simplicity.

Report this page